This is part 8 of our 10-part blog series on Ecosystems. You can find the other blogs in the series here.

It’s imperative to gain a comprehensive understanding on the key elements of a business ecosystem before considering how organizations can create value by following an ecosystem-based business model.

Different Types of Ecosystems

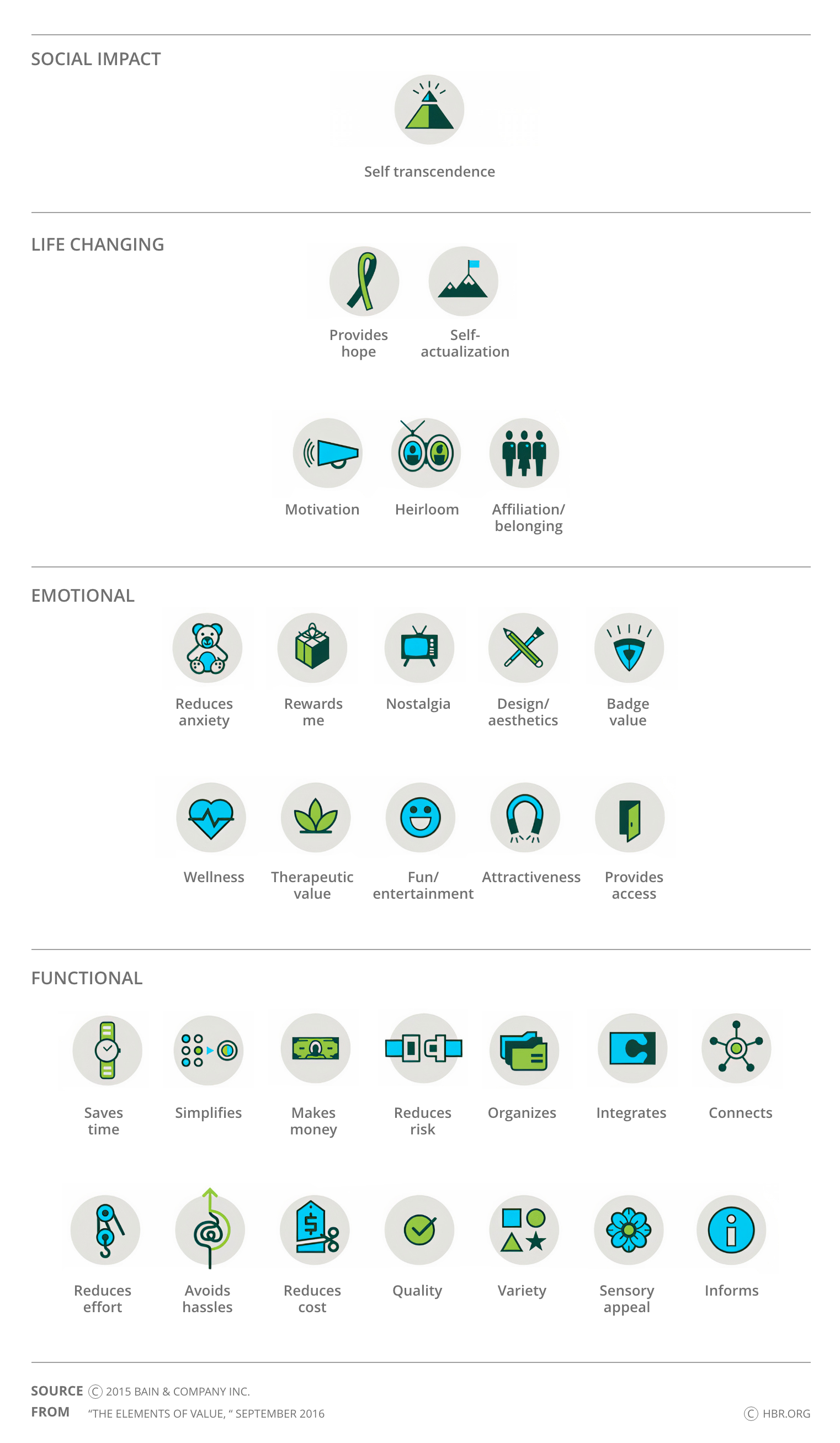

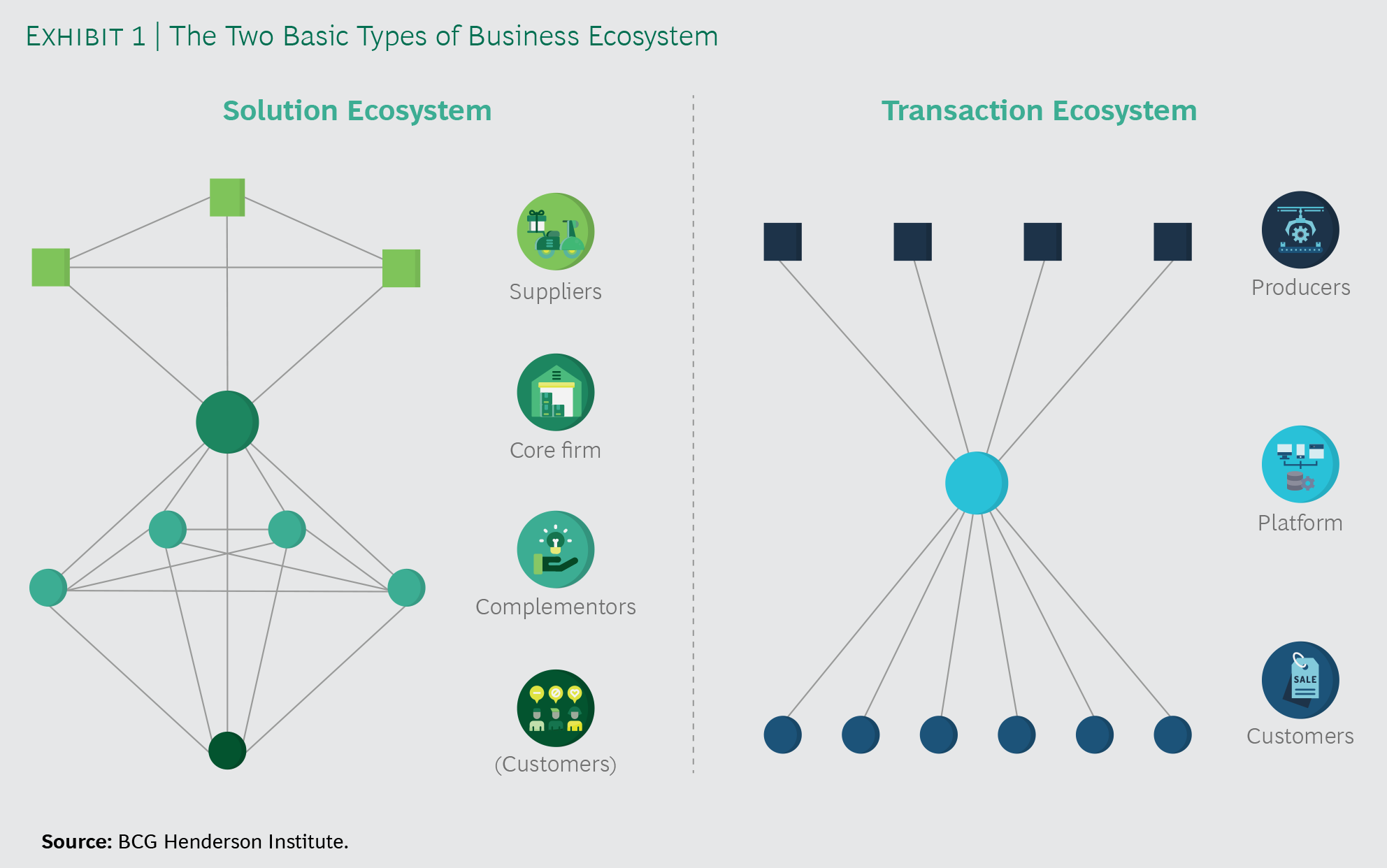

BCG points out that there are fundamentally two types of ecosystems:

- Solution Ecosystems: A “core firm orchestrates the offerings of several complementors. For instance, during the development of a new solution, suppliers to the core firm or to important complementors can also be part of the ecosystem because they are independent, and their innovation activities must be coordinated with the other players. Once the basic groundwork is accomplished, such suppliers may be restricted to a reduced role in a hierarchical supply chain. Examples of solution ecosystems include credit card systems such as VISA and Mastercard (linking merchants, consumers, and banks), smart home solutions (combining climate, lighting, entertainment, and security products and services, etc.”1

- Transaction Ecosystems: A central platform links independent producers of products or services with independent customers. Examples of such platform businesses are Airbnb, Uber, eBay etc.2

Figure 6 – Different Types of Ecosystems – from the BCG article Do You Need a Business Ecosystem?

But with the shift from vertically integrated organizations to horizontally integrated organizations, and with ever-evolving business models, we believe that there are other types of ecosystems – which are a direct outcome of the above two models.

Consider the Apple ecosystem for their phones. The Apple ecosystem, with the manufacturing of iPods, started with a strong vertically integrated model where the supply chain before in the upstream is akin to a traditional manufacturer and was similar to the solution ecosystem outlined above.

But, with the emergence of iPhone and the success of the iOS marketplace, the Apple “experience” which is the offering that Apple provides is a mix of the two models shown above. This is a new model of an ecosystem – a combination of the solution and the transaction ecosystem.

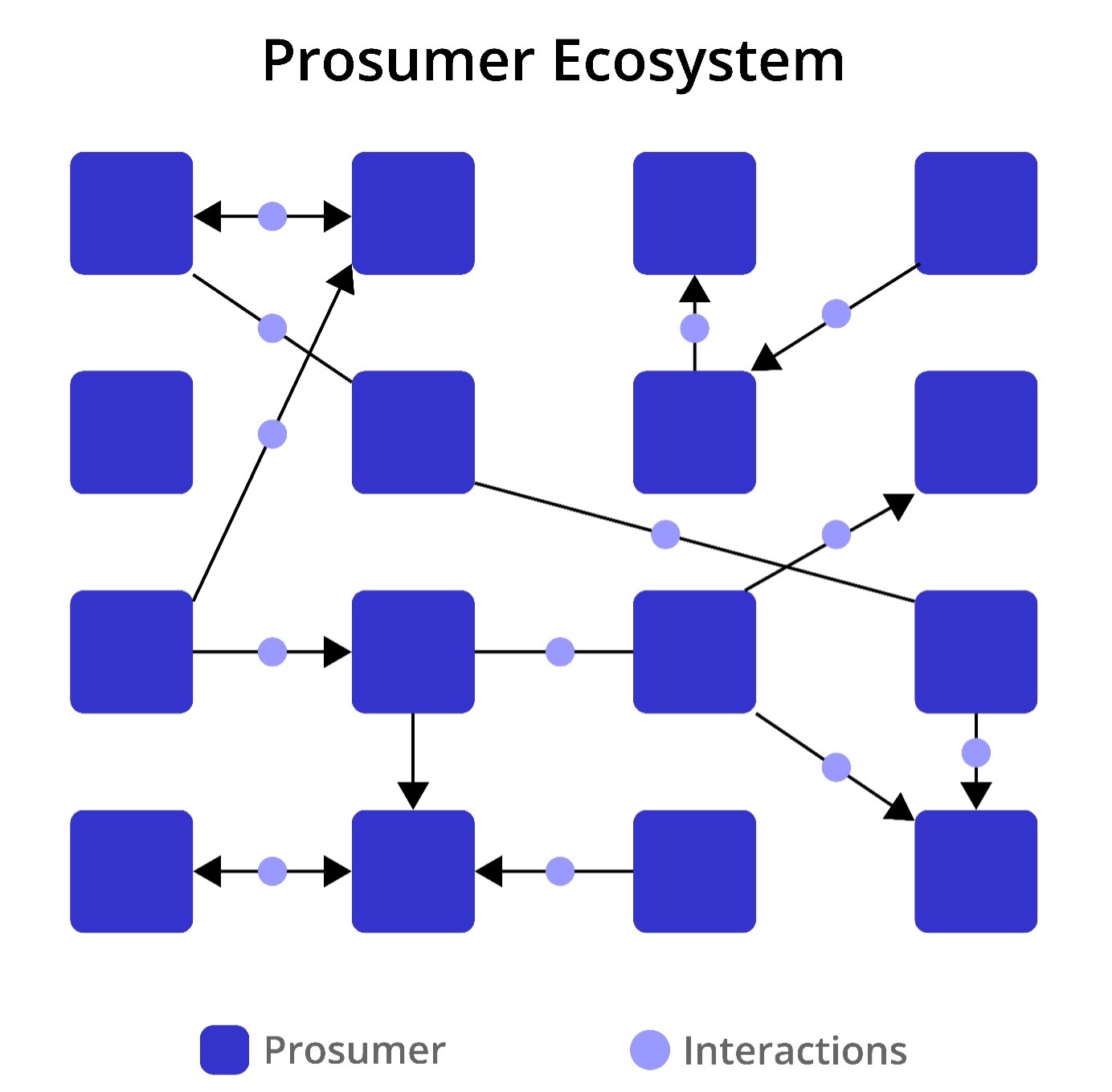

There is also another kind of ecosystem which does not necessarily put the producers and customers on a different side. If the transaction ecosystems focused more on matchmaking, the focus for this ecosystem is to generate more transactions. Here, in many cases, the producer and the customer are the same, with the revenue coming not from the producers or the customers, but from third parties. YouTube, and Facebook are examples of this kind of an ecosystem- a Prosumer Ecosystem.

Level of Control in an Ecosystem

An important realization the organizations will have to accept in an ecosystem business model is that the success of an ecosystem is not defined by the amount of control and the line of authority, but by the degree of influence and the level of flexibility within the ecosystem.

Apple, even though being pioneers of the marketplace model for their App store, follows a highly controlled, and closed ecosystem model. Google, which produces Android phones, follows a more flexible and open ecosystem model.

To decide the degree of openness required in an ecosystem, it is important that the following three aspects are considered 3 –

- The level of access required

- The level of participation required

- The level of commitment required

Open ecosystems drive faster growth and greater adoption, whereas closed ecosystems need a ground-breaking product to continue being relevant. Take the examples of Android, a highly open ecosystem with several phone manufacturers being part of the ecosystem, and Apple, which manages a highly closed ecosystem for its mobile devices. While the Android ecosystem has a relatively higher market share, the Apple ecosystem also points towards greater profitability.

While open and closed ecosystems provide a different set of advantages and carry another set of disadvantages in a B2C ecosystem, the advantages offered by an open ecosystem in a B2B environment is comparatively more vis-à-vis a closed ecosystem. Closed ecosystems, in a B2B environment may not be optimal for each of the modular solutions, and simultaneously can increase the risk associated with growing partnerships.4

On the other hand, the level of control that the central platform or the “keystone” has in an open ecosystem is greatly reduced vis-à-vis a closed ecosystem. The reduced level of control, without the help of other factors, may lead to a reduction in the value that the stakeholders derive from the ecosystem and may increase dissatisfaction with the ecosystem. This may also increase the chance of failure for an open ecosystem.

Hence, the right level of openness for an ecosystem will depend on factors such as – level of access, participation, commitment, and juxtaposing it with the targets for scalability, revenue growth and market share of the keystone or the prime orchestrator of any ecosystem. It is also possible that ecosystems start off at one end of the spectrum and move towards another end of the spectrum – either because of market trends or because of change in priorities.

Sources

2 Do You Need a Business Ecosystem?; Ulrich Pidun , Martin Reeves , and Maximilian Schüssler; BCG.com; September 2019

3 How Do You “Design” a Business Ecosystem?; Ulrich Pidun , Martin Reeves , and Maximilian Schüssler; BCG.com; February 2020

4“Open” vs. “Closed” Software Ecosystems: A Primer; https://leasepilot.co/blog/open-vs-closed-software-ecosystems-a-primer/; Retrieved on 17 July 2020